(let us know at talpredator@gmail.com)

It did to this woman, my mother; repeatedly, professionally, ruthlessly.

Her name is Una Ellis, and she passed away in Winchelsea, Australia on October 24, 2023. She was aged 82, and had suffered profound clinically-diagnosed dementia and Alzheimer’s Disease since 2020.

A few weeks before she passed, with her semi-conscious in an end-of-life care facility, my brother Barton – I am the eldest of Una’s three children – discovered that she had a funeral insurance policy with TAL Insurance, which likes to boast it is Australia’s biggest life insurer and is owned by Japan’s Dai-Ichi Life.

A private and independent woman, Una had bought that policy from a TAL associate, Apia, in 2011. She was then heavily grieving the recent loss of her husband Kevin. His funeral was expensive and, ever selfless, Una must have worried about her children, particularly her only daughter who she made sole beneficiary, having to pay for her own eventually.

Thus Una’s financial fate was sealed within the grasping reach of TAL and its associates.

By the time she died, after more than a decade paying monthly premiums, she had paid far more, $1000s more, to Tal/Apia than the designated amount they were ever going to pay for her fixed policy, that matured upon her death. Tal and associates unilaterally increased her premiums by as much as 10-11pc each year, claiming inflation, despite inflation through that decade being measured at just 1-2pc most years. If Una didn’t agree to the increase, which TAL/Apia levied by default, her cover would diminish.

But that was only part of the scam.

With her worsening dementia, Una became unable to manage for herself from late 2021. Her credit card, from which TAL/Apia extracted her premiums, expired. But Una didn’t know any of that because she had dementia. When a good samaritan eventually got her a new card so she could buy groceries, Una was by then profoundly ill. She didn’t know how or why to add her previous payees to it, whom she had forgotten anyway. Her automatic payments fell into arrears.

That’s when the predator devoured its prey.

No matter that Una, their policyholder, suffered dementia. That was inconvenient, profitless detail for TAL, a company that likes to advertise that its ‘Making a Real Difference At a Difficult Time.’ It cancelled her policy for non-payment, then abandoned her as he descended into deeper dementia. No-one knew, for 19 months until a few weeks before she passed, when the policy was first discovered by my brother Barton and his wife JT. By that time, the best that we could do for Una was to make her happy and comfortable.

TAL must know that dementia sufferers are often in denial of their condition, that they often resist and parry loved ones’ concerns, as the dignified Una did to the end. It’s part of what makes dementia so cruel. Una lost the $1000s she had paid TAL/Apia for more than a decade for her funeral. All that money Una had paid for years was now TAL’s to keep. There would be no funeral benefit windfall for her daughter, her intended sole beneficiary, as Una had selflessly intended back in 2011.

Tal had clinically fleeced a vulnerable pensioner suffering deep dementia.

My research reveals that Una Ellis was not alone. There are many similar examples in Australia, and most involving TAL. Health authorities estimate that Australian dementia sufferers will double in number by 2058, from almost 500,000 now. And for Australia read an ageing world. Such statistics seem baked into insurance industry business models. For predators, the demented present as a profitable free-for-all, proverbial lambs to the slaughter of unscrupulous enterprises making the cynical calculation that there’s a huge pool of free money to be plundered as ageing policyholders become demented, deteriorate, default and die.

Such projections must invigorate TAL’s collective dark soul as they lapse policies; the free and easy money, the profits, the executive bonuses, such a magnificent bounty of the vulnerable, the low-hanging fruit to harvest.

Many funeral policyholders think they are entering a savings plan, as if TAL was a bank. We are sure that is what Una would’ve thought it. But they are not savings plans, and TAL is not a bank. They are blithely entering a scam. It’s that simple.

Thousands of Australians are vulnerable to companies like TAL, and they lack a voice or an authority to speak on their behalf. Posthumously, Una has me, a media professional, who is speaking up for her after her death, after learning too late how expertly she was scammed.

Now, 21 months after lapsing her policy, with zero contact from them in between, TAL has suddenly decided to again take notice, but curiously doing so only after I waved my media credentials at them, after earlier spurning an inquiry from Barton and JT, who are not journalists. But most people don’t have journalists in the family to defend them, to reveal and expose scammers. And, I learn, regulation of this product sector is poor to the point of being non-existent. So predators like Tal rip off the vulnerable off at will.

I got a result of sorts for my sister, but it’s not a trade. (And it was hardly a result; to reinstate Una’s policy, TAL demanded around another 30pc of the entire basic policy value in extra premiums, on top of what my mother had already paid over the previous 11-12 years, to pay out the original policy as Una intended.)

TAL may think that placates me, and I will now go away for them to continue targetting society’s most vulnerable.

That’s not going to happen.

As I probe further how they did scammed her, TAL’s response to me so far has been to evade, obfuscate, block, delete, censor and avoid my questions while covering up their appalling behaviour.

Corporate predators like should not be allowed anywhere near the vulnerable.

If you, a friend or a relative have been fleeced upon by TAL or its competitors, let us know at talpredator@gmail.com.

Or if you are a TAL employee or agent and are uncomfortable about such predatory behaviour, be a whistleblower to that same email address. Your privacy and identity is 100pc guaranteed.

Such companies should not be allowed to do business.

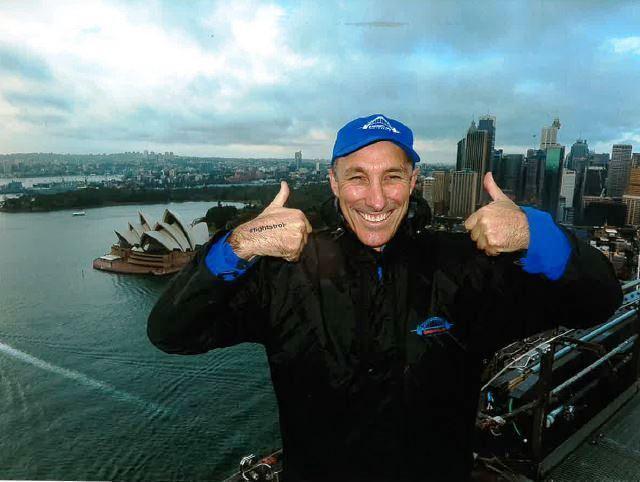

(Feel free to tell TAL Holdings CEO Brett Clark – this is him below being vital, or maybe he’s just thrilled, high on Dementia Dollars, after hearing that TAL got hold of all of Una’s money, and that of thousands of vulnerable Australians like her – what you think of his management and his company’s behaviour at brett.clark@tal.com.au)